Component Based Depreciation

Component based depreciation (CBD) provides a greater level of accuracy for depreciating an asset and reflecting its true asset value. This is achieved by extracting the major components from an equipment and capitalising and depreciating them separately.

For example, a haul truck with a purchase price of $3,000,000 could be split into the following components:

| Item | Price |

|---|---|

| Base Haul Truck | 2,580,000 |

| Engine | 200,000 |

| Transmission | 60,000 |

| Final Drive - Left | 80,000 |

| Final Drive - Right | 80,000 |

| Total | 3,000,000 |

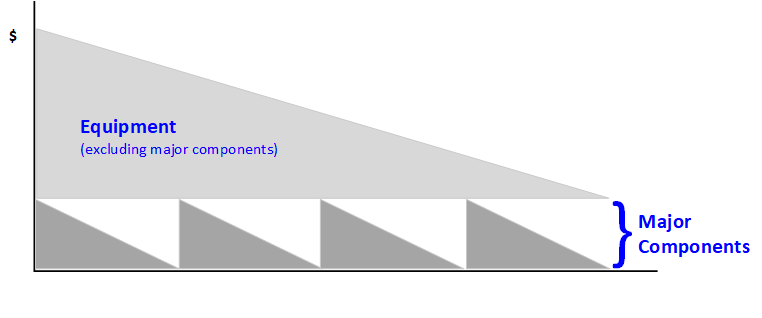

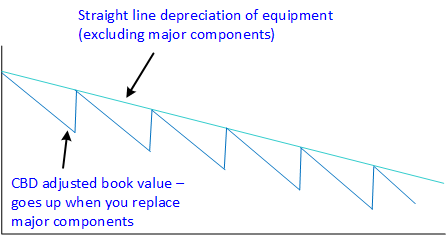

This approach recognises that the value of equipment is determined by its age and condition of its components. The major components are depreciated over their specific lives which creates accumulated depreciation (known as the CBD account).

Equipment depreciation is split into two elements: equipment and major components.

Impact on asset value.

This approach

- smooths operating costs, which helps to avoid incurring large costs. Depreciation is a more consistent expense than having to expense the costs of component rebuilds.

- prevents the business from taking profit early from money that should be set aside for future maintenance.

- aligns book value to market value.