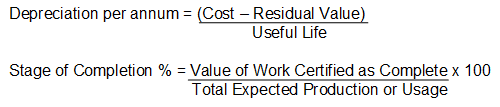

Units of activity depreciation

This depreciation method is also known as Units of Production or Units of Usage depreciation, and calculates depreciation on the basis of expected output or usage.

Advantages

- Most accurately reflects the pattern of consumption of economic benefits.

- Suitable in the case of fixed assets that depreciate in proportion of units of activity rather than just the passage of time.

Disadvantages

- Difficult to determine and measure a reasonable basis of activity.